Report: Spend Less and Live Better

Dated: May 14, 2025

Introduction:

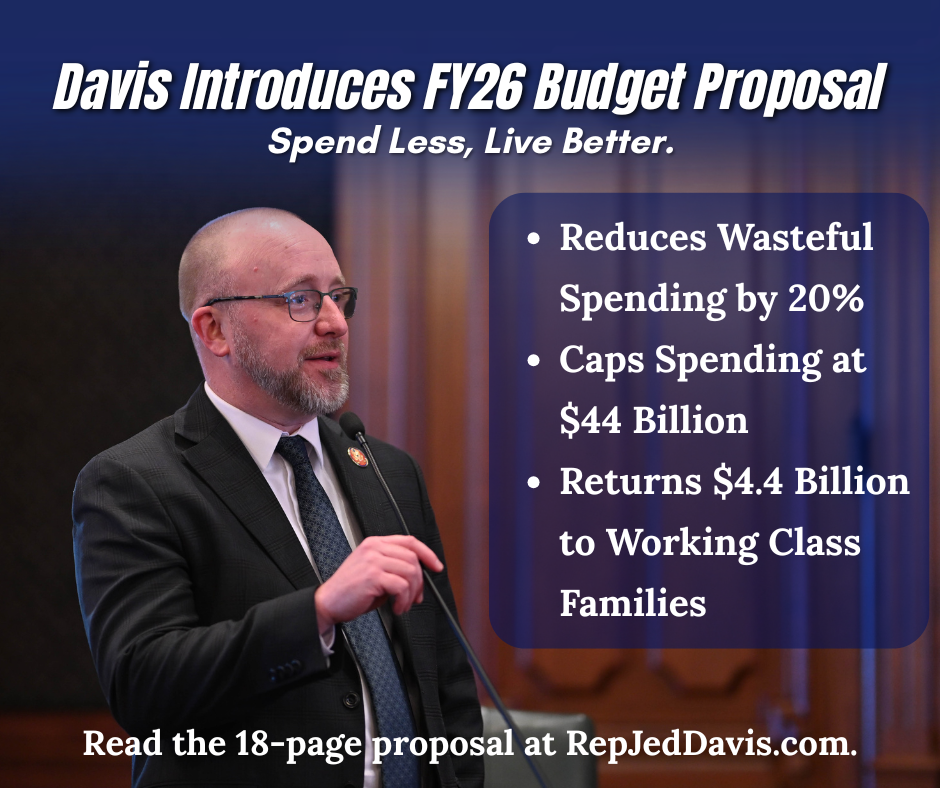

Our state budget has exploded from $40 billion in 2019 to a proposed $55 billion in 2026, a $15 billion increase. $15 billion over 7 years!!! We can’t keep demanding more from taxpayers through increase after increase after increase. So instead of another increase, this report takes a different approach, identifying real savings while protecting essential services. The motto is simple: let’s spend less and live better.

This report proposes a smarter budget for a better Illinois, ultimately outlining practical ways to lower your cost of living. The result is more money in your pocket, where it belongs. Please note I’m only scratching the surface of potential savings, and a deeper dive into government waste, overreach, and inefficiency is warranted. Use this report as a discussion starter.

Disclaimer:

I’m a one-man rodeo, not the executive branch surrounded by an army of agencies and employees spending countless hours drafting the budget. These pages aren’t exhaustive, but every recommendation hits the mark. It’s all driven by one goal: lowering your cost of living.

This report examines the fiscal year 2024 and fiscal year 2025 budgets, providing the most complete and recent data on state spending. By breaking down expenditures, highlighting wasteful patterns, and identifying potential savings, this report builds a clear picture of where taxpayer dollars are going and where state reforms are needed.

The fiscal year 2026 budget is currently being drafted behind closed doors, making it unavailable for legitimate analysis. However, the cost-saving opportunities and spending trends identified here will largely apply to the upcoming budget as well. This report provides a roadmap for responsible budgeting, prioritizing fiscal discipline and taxpayer interest over unchecked government expansion.

I’m simply prioritizing you. After all, our shared cost of living is currently driving a runaway car. It’s time we pump the brakes together.

Budgeting Truth in Illinois:

The budgeting process in Illinois is anything but transparent. Year after year, it’s a closed-door, partisan operation controlled entirely by Democratic leadership. Instead of an open and collaborative approach, where all elected representatives have a voice, the budget is secretly dictated with little to no input from across the aisle, effectively ignoring the voice of millions and silencing all opposition. It’s complete garbage, and voters deserve better.

Furthermore, appropriation committees in Springfield are bipartisan illusions. They’re theater – nothing more. Republicans shouldn’t assign members to these sham committees. By playing along, we’re only legitimizing a broken system!

This process is exactly why I combed through the budget, line by line, identifying areas of real savings. I’m not here to rubber stamp another year of reckless spending. I’m here to offer solutions grounded in transparency and truth. Illinois has sadly blocked these values from the budgeting process. I’m opening the door, inviting them back to the table as partners.

Key Findings and Proposed Savings:

This report breaks down spending increases agency by agency (FY24 to FY25), highlighting surging costs and identifying saving opportunities. By following the money, we can see where taxpayer dollars are being used efficiently – and where they’re potentially being wasted. Let’s get started by discussing a smarter budget for a better Illinois…

1) A Smarter Budget for a Better Illinois:

Illinois doesn’t have a revenue problem – it has a spending problem. Governor JB Pritzker is proposing a $55 billion budget next year, the largest in state history. But bigger government hasn’t made life more affordable for working families – it’s only made it harder. It’s time for a new approach.

After my agency-by-agency review, I’m proposing a $44 billion budget – a whopping 20% reduction from the Governor’s plan. This proposal isn’t about slashing essential services. It’s about rooting out waste, restoring fiscal sanity, and ending government overreach. We can reduce the size of government without hurting the people who fund it.

But I’m not stopping there.

From these savings, I propose returning $4.40 billion directly to working families with $1,500 checks hitting every household earning $100,000 or less. These households are the ones crushed by rising costs, reckless spending, and overtaxed incomes. They deserve a boost, so let’s make it happen ASAP!

Even after returning billions to taxpayers, we still cut the budget by over 12%, landing at $48.4 billion. From there, let’s target revenue deductions for subsequent years, continually putting money into your pockets, not state pockets, ultimately lowering your cost of living. After all, honest question, has record spending improved your quality of life as an Illinois resident? Do you notice a dramatic difference? Remember, we’re talking a $15 billion difference!!!

This approach is what common-sense, conservative leadership looks like – not more government, but more freedom, more money, and more opportunity in the hands of the people who earned it. This work will be hard, but rewarding! Here are some avenues for the proposed savings.

2) Capital Development Board ($1.52 billion increase FY24 to FY25):

2A) IL Dept of Corrections Capital Improvements ($900M FY25):

The Illinois Department of Corrections (IDOC) was allocated nearly $900 million for capital improvements during FY25, a staggering figure warranting some scrutiny. Constituents consistently contact my office, raising concerns over failing infrastructure throughout IDOC facilities – from deteriorated buildings to outdated systems. There’s no doubt investment is needed, but with nearly $1.00 billion on the table, how is this money being allocated and prioritized?

We need accountability and transparency to ensure this funding is being wisely spent on the most urgent needs, not mismanaged on politically motivated projects. I remain skeptical, so I sent a letter (attached here as Exhibit A) requesting detailed clarification on the allocation of these funds. I’ll share the response as taxpayers deserve to know where their money is going.

2B) Deferred Maintenance and Infrastructure ($450M FY25):

The state also allocated $450 million for deferred maintenance and infrastructure, but the lack of clarity regarding spending raises concerns. After all, not all maintenance projects are created equal – some address urgent safety hazards, while others fall into the category of nonessential upgrades. Let’s ensure funding is directed toward truly critical repairs.

Summary:

We’re looking at $1.45 billion between only these two items, with an overall increase year over year of $1.52 billion. If there’s one word you’ll see throughout this report, it’s ‘increase.’ At this point, I think Illinois has deleted ‘decrease’ from the dictionary. I conservatively use $1.00 billion as potential savings below.

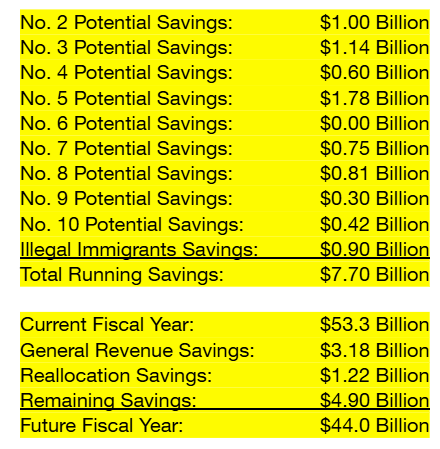

Potential Savings: $1.00 Billion (capital development and general revenue fund)

Running Savings: $1.00 Billion

3) IL Dept of Commerce and Economic Opp ($1.38 billion increase FY24 to FY25):

3A) Quantum Manufacturing Subsidies ($500M FY25):

Illinois is throwing half a billion dollars at a speculative industry, essentially hoping it pays off. History tells us private investors will show if quantum manufacturing is truly the future. All to say, taxpayer money shouldn’t be venture capital. Government picking winners and losers never ends well, and public funds should never prop up unproven markets. If the private sector believes in quantum manufacturing, let them foot the bill.

3B) Grants to Local Governments and Organizations ($487M FY25):

Nearly half a billion dollars in grants, wow! These grants often reward political friendships, interests, and motivations, mostly favoring the majority party while forgetting the general public. This scenario creates dependence, not development. Let’s stop subsidizing political operations and start promoting local policies – policies rewarding self-sufficiency – like fully funding the local government distributive fund. Everyone hopefully agrees, taxpayers shouldn’t be on the hook for permanent handouts.

3C) Broadband Expansions ($150M FY25):

Taxpayer-funded broadband sounds great, until you realize it’s a public subsidy for private profit. There’s no reason major internet providers can’t fund infrastructure, especially when posting record earnings. Instead, the state should be focused on cutting regulations, not cutting checks to benefit corporations. Let the free market expand broadband, not Springfield. I recognize some costs may include federal pass-throughs.

Summary:

We’re looking at $1.14 billion here. Somewhat a great start. Illinois spends billions on programs like the ones noted above, but prosperity comes from cutting, not growing, government. So step aside Illinois, and watch the free market lower everyone’s cost of living. Please reference Exhibit B, attached as a corresponding policy statement.

Potential Savings: $1.14 Billion (capital development and general revenue fund)

Running Savings: $2.14 Billion

4) IL Dept of Transportation ($1.33 billion increase FY24 to FY25):

4A) Statewide Road Construction ($1.34B FY25):

Illinois voters approved a transportation lockbox allocating gas tax dollars only for infrastructure, but now we’re looking at over $1.30 billion in Illinois Department of Transportation (IDOT) road spending, and it’s unclear if taxpayers are getting their money’s worth. The problem isn’t revenue, it’s efficiency. Significant balances sit unused with IDOT struggling moving projects. I suggest streamlining the process, opening the books, and lowering the gas tax before greenlighting more road spending. I also suggest using design-build over design-bid-build. Design-build saves dollars. Most importantly, let’s keep projects moving while pursuing savings here.

4B) Electric Vehicle Infrastructure ($149M FY25):

This $149 million isn’t about clean energy, it’s about government subsidizing a whole private industry. If electric vehicles are truly the future, then the associated companies and utilities should lead the charge, not taxpayers. Public funds should be spent maintaining bridges and roads, not helping billion-dollar corporations build customer bases. Are you catching a common theme? 🙂 A theme letting the market decide, not the government dictate.

Summary:

Who knows, possibly not a permanent solution, but it’s worth pursuing while “unboxing” 4A above. So let’s assume a portion for potential savings, giving IDOT the benefit of the doubt.

Potential Savings: $0.60 Billion (capital development fund)

Running Savings: $2.74 Billion

5) IL Environmental Protection Agency ($1.31 billion increase FY24 to FY25):

5A) Wastewater Loan Programs ($1.63B FY25):

Illinois is pumping over $1.60 billion into wastewater loan programs, mainly covering the cost of mandated upgrades. Overregulation is the real driver of these costs. Excessive mandates force local governments and utilities to make expensive upgrades, not because systems are failing, but because politicians are regulating. Let’s press pause and review the relationship between costs and regulations. I promise, trim regulations and we’ll automatically trim costs.

5B) Climate and Clean Energy Programs ($681M FY25):

$681 million for climate and clean energy programs, driven more by political priorities than practical needs. If these initiatives are truly viable, the private sector will invest. Taxpayer dollars propping up political agendas isn’t investing, it’s more like subsidizing. We’re also undercutting companies offering affordable and reliable energy. As a result, heating and lighting your home is more expensive than ever. Another reason your cost of living continually trends up, up, and away.

Summary:

Please reference Exhibit C, attached as a corresponding policy statement. I’ll be conservative here, capturing only a portion of the above costs as potential savings.

Potential Savings: $1.78 Billion (capital development fund)

Running Savings: $4.52 Billion

6) IL Lottery ($1.06 billion increase FY24 to FY25):

6A) Watching the Watchers:

The lottery isn’t funded through the general revenue fund, but I’m not handing out free passes. We’re seeing increased player payouts of $1.00 billion and increased administrative costs of $53 million. These numbers demand a few basic questions.

- Is the state maximizing returns or just bloating systems?

- Is the lottery still fulfilling the mission of funding schools, or just feeding itself?

- Are marketing strategies and prize structures responsible and sustainable?

Summary:

I’ll leave these savings and questions for another day, but wanted them on record here.

Potential Savings: $0.00 Billion (capital development fund)

Running Savings: $4.52 Billion

7) Central Management Services ($1.04 billion increase FY24 to FY25):

7A) State Employee Insurance Plans ($1.00B FY25):

Central Management Services (CMS) quietly absorbed over a billion-dollar increase, with the vast majority tied to state employee insurance plans. Why are costs ballooning? Perhaps a mix of expanding services, increasing enrollees, and rising premiums? It’s time we explore cost-sharing reforms, protecting employees but also respecting taxpayers, many struggling with healthcare costs. I sent a letter (attached here as Exhibit D) requesting detailed clarification on this increase. I’ll share the response as taxpayers deserve to know where their money is going.

7B) Administrative Expenses ($15M FY25):

CMS also posted an increase in administrative costs and professional contracts, areas ripe for duplication and waste. I firmly believe savings are available here, classifying these dollars as low-hanging fruit.

Summary:

I’ll be conservative once again, maintaining the trend of showing some benefit of the doubt. Keep in mind though, Illinois has added approximately 11,500 government jobs since 2019. This increase has offset a loss of approximately 1,900 private sector jobs over the same period, making Illinois one of the few states where public employment growth has outpaced private sector gain (per the US Bureau of Labor Statistics). Ugh! I recommend auditing this growth as it’s directly connected to 7A above.

Potential Savings: $0.75 Billion (general revenue fund)

Running Savings: $5.27 Billion

8) IL Dept of Children and Family Services, Aging ($509 million increase FY24 to FY25):

8A) Fresh, Heartfelt Approach:

Illinois is pouring another half a billion dollars into foster placements and seniors. Here’s my question as a foster parent. Are we truly improving lives? I believe the current model is too institutional, too impersonal, and too expensive. Community-driven and faith-based organizations are often better equipped for personal, compassionate care. Why not partner there to 1) deliver better outcomes at lower costs, 2) expand overall capacities, and 3) offer more local and relational senior care options. Let me be clear, this one isn’t about cutting services, it’s about delivering them better, smarter, and with heart. We need out-of-the-box strategies in Illinois!

Summary:

This increase is likely tied to additional staff. My community-driven and faith-based approach backfills staff, so I’m removing this increase along with assuming other savings. Please reference Exhibit E, attached as a corresponding policy statement.

Potential Savings: $0.81 Billion (general revenue fund)

Running Savings: $6.08 Billion

9) IL Teachers’ Retirement System ($240 million increase FY24 to FY25):

9A) Pension Contributions ($160M) and Retiree Insurance Plans ($48M FY25):

My mom was a public school teacher for over 30 years. Like many retirees, she’ll tell you, “TRS is flush with cash.” And on the surface, she’s right. TRS manages over $65 billion in assets, but there’s a BIG problem. This money is already spent. Despite the size of the fund, TRS is only about 45% funded. We’re not ahead, we’re behind, and the gap is growing. Without digging into the weeds here, let’s stop pretending short-term payments solve long-term problems. I suggest a pension lifeline commission, consisting of taxpayers, teachers, and retirees. No more looking the other way, let’s facilitate honest conversations and true solutions with everyone around the table.

9B) Chicago Teachers’ Pension Contributions ($30M FY25):

And once again, the state is covering $30 million of Chicago’s local pension costs, even though every other district in Illinois pays its way. Taxpayers from downstate and the suburbs shouldn’t be forced to subsidize a district they don’t control. It’s definitely not principles, it’s politics.

Summary:

The pension issue is a mountain, not a hill. I’m only removing the Chicago portion here.

Potential Savings: $0.30 Billion (general revenue fund)

Running Savings: $6.38 Billion

10) IL Dept of Human Services ($155 million increase FY24 to FY25):

With another $155 million added to the Illinois Department of Human Services (DHS), they’re doubling down on massive government-run programs. Wow! Are we truly solving problems or simply managing dependencies?

10A) Summer EBT Programs ($600M FY25):

This program provides food assistance during the summer months when schools are closed. $600 million warrants asking if this program is sustainable? I’m not ignoring hungry children, only suggesting long-term handouts shouldn’t replace long-term solutions. This need is another great opportunity for partnering with community-driven and faith-based organizations. This partnership will save costs and improve services. I recognize some costs may include federal pass-throughs.

10B) Workforce and Youth Job Programs ($119M FY25):

Illinois is spending $119 million on state-run job programs. What’s the point? Especially when industry groups, small businesses, and trade organizations already provide career opportunities. I recommend offering tax incentives, encouraging businesses to engage workers of all ages. This path is more sustainable than expanding government payrolls.

10C) Housing Assistance Programs ($90M FY25):

Housing assistance is important, but only with clear results. Right now, too many dollars are administrative costs, and too few dollars are actual outcomes. I recommend results-based accountability across every housing initiative. Programs should help people reach independence, or they shouldn’t exist.

Summary:

This one completes our agency-by-agency review. Please reference Exhibit F, attached as a corresponding policy statement.

Potential Savings: $0.42 Billion (general revenue fund)

Running Savings: $6.80 Billion

Conclusion:

This report represents a complete about-face from the current direction of Illinois government, challenging the spend more and care more myth. I make the case for something greater. Spend less and live better.

The recommendations above don’t nibble around the edges. They call for fundamental course corrections, and implementing them will take time, like establishing partnerships with community-minded and faith-based organizations. It’s all possible with courage, dedication, and hard work.

Keep in mind, this report doesn’t touch everything. One glaring omission is illegal immigrants. Cutting spending there conservatively adds another $900 million to the running savings. Also, don’t overlook yesterday’s press conference hosted by the Illinois Freedom Caucus. Hundreds of millions in spending for nongovernmental organizations were exposed during this conference. And finally, this report leans on caution, rarely applying the full savings available per agency.

As noted in the introduction, use this report as a discussion starter. I likely propose some unrealistic cuts, but I also left out some low-hanging fruit (see previous paragraph). Either way, this report is a massive win. I did the hard math, nearly forging a path to my proposed $44 billion budget. The remaining distance will come from sifting through all other departments and expenses absent here. We didn’t even touch the IL Dept of Innovation and Technology or the IL Dept of Public Health. As noted above, some of my proposed cuts touch the capital development fund. These cuts often come from departments with both capital development and general revenue fund allocations. I recommend reallocating some of these savings between funds.

Shrinking revenues will also take time, so immediate excess will fund my proposed $1,500 checks to working families. These results are representative of lowering your cost of living. Shazam! Here’s a quick recap…

We’ll find the remaining savings of $4.90 billion by collaborating with other departments and nongovernmental organizations as a team. This report already highlights $4.40 billion in general revenue savings with just me, a one-man rodeo. Also, don’t forget billions more in capital development savings.

Publishing this report is risky business, and I know it.

Some will say, “Jed doesn’t care about kids, seniors, or teachers.” Please know these misrepresentations are exactly why nobody publishes numbers. Staying quiet is far safer, following a go along to get along approach. Even my caucus told me an alternate budget is impossible. Too much risk and too much work. Well – hogwash!

How can anyone stay quiet while the state keeps spending more, and the people keep getting less? The cost of living is crushing people, and Springfield only institutes increase after increase after increase. I’m courageously standing tall by publishing this report, saying enough is enough!

We can chart a new course, one built on common sense. We can hit $44 billion. We can send $1,500 checks. I’m wondering, is anyone from the General Assembly truly willing to work together? My door always remains open, and I’m ready. Closing with the words of White Sox legend Ron Kittle, let’s “coffee up” and get to work!

Respectfully and Sincerely,

Jed Davis

IL State Representative, District 75

Exhibits:

These exhibits are critical as they demonstrate a difference in thinking, and this difference creates two completely opposing budgets, the $55 billion and the $44 billion. So, these exhibits may seem trivial, but they’re the backbone of fundamental thoughts ultimately driving your cost of living. Again, spend less and live better!

Exhibit A: IL Dept of Corrections Increase Inquiry

Exhibit B: IL Dept of Commerce and Economic Opportunity Policy Position

Exhibit C: IL Environmental Protection Agency Policy Position

Exhibit D: IL Dept of Central Management Services Increase Inquiry

Exhibit E: IL Dept of Children and Family Services, Aging Policy Position

Exhibit F: IL Dept of Human Services Policy Position, Page 18